Australian Car Insurance Market ANALYSIS

We have become so used to paying outrageous premiums for the automobile insurance policies that people find ourselves filled up with doubt once we hear we may very well be paying a reduced amount of. Cheap automobile insurance is offered in commercials and may be provided by a surprising variety of companies if you meet qualifications for example multiple vehicles, an automobile with safety features, or possibly a good driving record. When you decide on a company that gives an insurance policy only for a percentage of what you currently pay, however, there exists a good possibility that the first instinct can be to wonder what's wrong using the policy.

So what is term life insurance? It can be a kind of savings in the end and it gives monetary assurance on the beneficiaries as soon as the owner of the insurance policy dies. Most establishments offer this type of policy to their employees so that their loved ones will never be left empty handed just in case death or critical illnesses falls upon them. It can cover the potential risk of early death thus motivating us to function hard and keep on top of the repayments since it is for the sake of our loved ones' future. It can at the same time protect your mortgage in the event you own one. You can choose your beneficiaries and it is up to you the amount benefits will probably be used on each one of which.

To begin with, you have to realize that basic principles of those policies are the same as others. This means, to get these policies, you must choose the right one, give the premium and claim at the appropriate interval. The difference though, is based on the amount premium will have to be paid, the conditions that will be covered as well as the total importance of the cover. What has being swallowed being a bitter pill as being a facts are that, even senior citizen medical insurance India cannot guarantee complete and unlimited coverage on the ones who approach even though they are in perfect fitness with minimum reputation issues. For example, while there are some businesses that cover hospitalization and treatment bills of up to 3 lakhs, you'll find others who allow more and there are some that provide even lesser. The premium however, to expect to be greater than people at a much younger age will be charged for similar quantity of sum-assured.

Current Income: The earning that you've with the current economic period will ultimately select how much premium you would pay. If you desire to have an increased earning over the Income Protection Insurance plan, you must opt for level premium option. This will be sure that your income gets increased in the time period. Level premium begins with cheaper payments and increases of living: If you are alone to find the benefit or you have a family for everyone. This is again an important question to resolve. Your cost of living is also an important factor to determine which type of Income Protection plan you should choose. Select a plan that can ensure providing best benefits to your husband or wife and youngsters even if you are unable to work and earn a deductions: The type of policy that you simply choose will determine the tax deductibility. Some of the plans offer better tax efficiency than other Income Protection Insurance in Australia.

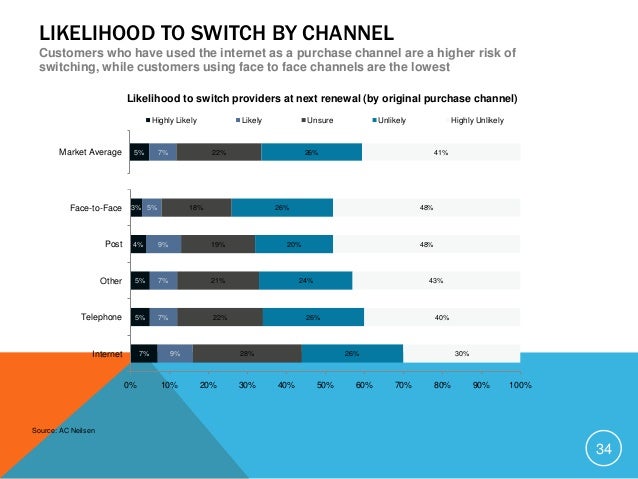

One's perception of how various asset classes will work in numerous economic scenarios can also influence one's switching decision. For example, if equity markets look significantly overvalued and expensive, policyholders may change of equity funds simply to switch back when equity markets correct substantially. Many Insurance Funds offer trigger options which facilitate automatic switching in line with the behavior of the underlying assets in the fund.